Advanced Predictive Analytics versus Traditional Historical Forecasting

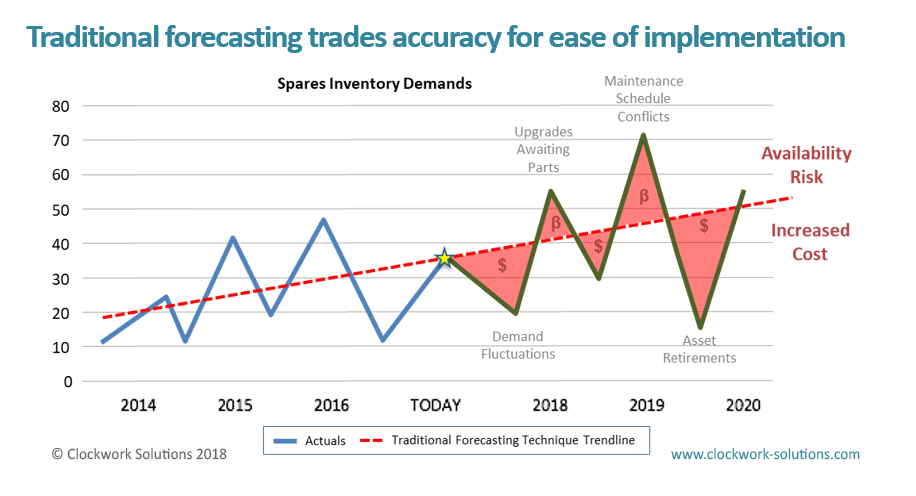

Traditional forecasting, using historical observations estimate future business metrics such as inventory requirements, asset performance, budgets and revenue. Compared to predictive analytics, this practice fails to deliver the precision and agility required of leading enterprises and effective IoT asset management programs meeting difficult challenges. The reason for this shortfall is simple: the past does not represent the future in dynamic operations that must respond to changing maintenance practices, aging equipment, engineering innovations, reliability improvements, and highly variable world-wide operations.

The past does not equal the future for asset performance management in seemingly chaotic environments. Yet traditional, historical forecasting attempts to shape trend lines, force moving averages, and smooth out variability. These methods miss a key point: the variability in future metrics must be accurately measured and represented with detail—not smoothed and flattened away.

Over-simplifying assumptions in traditional forecasting create models of components and assets that do not age, process that never change, and environments that are certain. For clear, accurate decision support, predictive modeling must capture complicating factors in detail. Yet, traditional forecasting is too restricted to meet this obligation.

These traditional, historical methods include many time series forecasting techniques and related models that are severely limited when applied to complex systems: exponential smoothing, moving average, Bayesian networks, trend models, segmentation, regression, cross-sectional forecasting, extrapolation, queuing theory analysis, etc.

In simple systems that reach steady state like modeling the lunch rush through a cafeteria, or predicting the number of tellers needed at a bank, traditional forecasting can work. In a controlled, sterile academic classroom, these models play a role in demonstrating simplified systems. However, when mission readiness, diminishing budgets, operating capacity, and corporate bottom-lines are at stake, traditional forecasting must be replaced by precise and mature predictive models and that yield efficient and effective prescriptive actions.

Advanced Predictive Analytics vs Traditional Historical Forecasting

The difference between predicting with traditional forecasting vs. high-resolution simulation is summarized in the table below:

Advanced Predictive Analytics |

Traditional Historical Forecasting |

|

| Focuses on assets, their components, operations, and activities that sustain these assets through both planned and unplanned maintenance. Models a holistic and detailed asset lifecycle including components, operation, reliability, maintenance, sustainment, and supply. | vs | Views demands in isolation. Fails to connect assets operations to performance metrics and costs in an accurate and detailed manner. |

| Future insights defined through the power of predictive simulation. Generates volumes of future metrics that define set of possible outcomes to include new strategies, environments, and fleet management challenges not encountered in the past. Specifies detailed future outcomes with time-based KPIs to enable well-informed decisions and prescribe effective actions. | vs | Relies entirely on historical data; limited to examining the past. Forecasts are tightly coupled to past events. This fundamental flaw creates a gap between forecasts and actual observations in dynamic systems where the future does not equal the past. |

| Leverages many replications of possible future outcomes to allow a deep understanding of risk, uncertainty, and confidence in reported metrics. | vs | Fails to separate natural variability from meaningful relationships because only one set of historical data exists (i.e. not possible to repeat the past to generate new outcomes). |

| Eliminates the need for over-simplifying assumptions. Explicitly quantifies and represents reliability, maintenance tasks, shipment delays, repair effectiveness, and other sources of uncertainty. Models aging on a component level. Includes complex, probabilistic age modeling including independent component aging and restoration, updating of age distributions based on failure or maintenance events. | vs | Requires many over-simplifying assumptions about the nature of inputs that include uncertainty. Uses static time models; assumes that asset, parts, and components do not age over years of operation. Assumes maintenance is unchanging over time |

Rigorous predictive analysis must be applied rather than limiting our approach to unfocused, historical data mining that merely identifies interesting correlations. Complete, evolving, iterative, and time-dependent decision analysis can deliver accurate views of the future so manufacturers should find ways to capitalize on data analytics.

This article was written by Serg Posadas, the VP of Industry Solutions at Clockwork Solutions. He brings depth of experience to Clockwork in technical and strategic leadership. Serg has been with Clockwork for eight years following a 22-yr Marine Corps career.

Sorry, the comment form is closed at this time.

Pingback: Advanced Predictive Analytics versus Traditional Historical Forecasting | Premium apps reviews Blog and Programing