Strategic options for creating smart solutions for Industrial IoT

The Internet of Things (IoT) enables vendors to create an entirely new line of “smart” solutions for its existing and new markets. While the decision to go “smart” is straightforward, the decision of how to do so is not. Vendors are faced with a “build, buy, partner” decision – build it themselves, buy or license it from someone, or partner with a complementary solution provider and go to market together. This article discusses some of the key considerations product managers and executives must study in order to make the most appropriate decision.

“Build, buy, partner” is a strategic decision

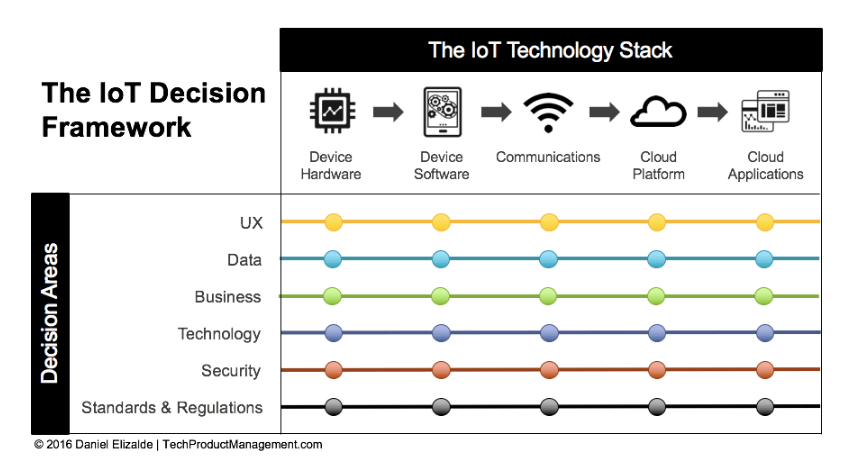

For many vendors, IoT means adding a technology layer to products that never had any before. Even for tech savvy vendors, IoT presents a whole new set of technologies that they are less familiar with. Equally important, IoT is not just technology, but includes data, security, user experience, and business/business model elements. Figure One shows an IoT product management framework developed by Daniel Elizalde of TechProductManagement. A company going “smart” has a lot of decisions to make, of which technology is just one component.

The framework shows that the “build, buy, partner” decision is multi-dimensional. There are six decision areas, spread across components from the edge to the user applications. Each represents a different “build, buy, partner” decision point, and each takes the company down a different path. In today’s fragmented and dynamic IoT ecosystem, many companies will need to “build, buy, partner” simultaneously. For example, cybersecurity is a specialized field that many vendors cannot address on their own, and must buy or license for their solution. The actual proportion of “build, buy, partner” each vendor does varies based on their specific situations. More about IoT Decision Framework: Factors & Challenges.

Build

The company creates the solution themselves with the resources they own, control or contract to. Companies who choose this option, but have limited internal expertise may contract with Original Design Manufacturers (ODM). These ODMs provide a portfolio of services, from design, prototyping, test, certification, to manufacturing. One example of an ODM, specializing in IoT, is Blue Clover.

The “Build” option enables full management oversight of the development process, the solution functionality and the intellectual property. Conversely, this option may result in a longer time to market, and require additional capital and resources beyond what is scoped.

Companies consider this approach when:

- They have the requisite skill sets and resources to do it

- They can do it faster, cheaper and at lower risk

- This is a strategic competence they own or want to own

- There is strategic knowledge or critical intellectual property to protect

- They are fully committed throughout the company

Buy

The company procures all or part of the solution components from a 3rd party. This includes licensing technology and services. Companies may also acquire technology through mergers and acquisitions, as well as buying the rights to technology from companies willing to part with it. This option eliminates “reinventing the wheel”, enables faster time to market, maximizes resource efficiency with limited execution risk.

One common variant of this approach is to buy technology platform from a vendor, and then build their specific solution components on top of that. For example, manufacturers developing smart industrial solutions can license an industrial IoT platform from ClearBlade. Similarly, Ayla Networks offers an IoT platform for consumer products manufacturers.

The downsides of the “Buy” option include a loss of control in the development process, and limited agility to respond in a timely manner to changes in the market and customer needs.

Companies consider this approach when:

- They don’t have the skills or resources to build, maintain and support it

- There is some or all of a solution in the marketplace and no need to “reinvent the wheel”

- Someone can do it faster, better and cheaper than they can

- They want to focus their limited resources in other areas that make more sense

- Time is critical and they want to get to market faster

- There is a solution in the market place that gives you mostly what you want.

Partner

The company allies itself with a complementary solution or service provider to integrate and offer a joint solution. This option enables both companies to enter a market neither can alone, access to specialized knowledge neither has, and a faster time to market. This option adds additional management and solution integration complexity. For some companies, reliance on partners for some aspects of the solution may be uncomfortable due to a limited loss of control.

Companies consider this approach when:

- Neither party has the full offering to get to market on their own.

- Each party brings specialized knowledge or capabilities, including technology, market access, and credibility.

- It lowers the cost, time and risk to pursue new opportunities

Management considerations for “build, buy, partner”

Before the company chooses a path to go “smart”, executives and managers must base their decision along three “build, buy, partner” dimensions – execution, strategy, and transformation.

The first dimension focuses on the company’s ability to execute successfully. Managers must audit and assess their capabilities and resources to answer the following questions:

- Do I have the necessary skills in-house to successfully develop, test, support and operate an IoT enabled “smart” solution and business (Figure One)?

- Do I have the right human, capital, financial, and management resources to do this? Is this the best use of my resources relative to other initiatives and projects?

- What am I willing to commit, sacrifice and re-prioritize to see this through? Am I willing to redeploy top management and company resources? How long am I willing to do this?

- How much budget and resources am I willing to commit?

- Is there anyone that can do it better than me? Does it make sense for me to do it? What am I willing to do and not do?

- What infrastructure (processes, policies, systems) do I have, or need to build, maintain, support and operate these new industrial IoT solutions?

The second dimension relates to the company’s current and future strategic needs. These are company specific as it relates to its current situation, its customer and channel, and its position within the industry. Key considerations to be addressed include:

- How does going “smart” align with the company’s vision and strategy? Which parts align and which doesn’t? Does the vision and strategy need to be updated to reflect the realities of going “smart”?

- How important is time to market? Do I need or want to be a first mover? How long will it take to execute with the resources that I have?

- Am I trying to reach existing or new markets with IoT? Do I understand their needs well enough that I can execute on meeting it?

- Do I have any critical proprietary technology, processes, and other intellectual property that I need to protect?

- What are the risks? How much risk am I willing to tolerate? What are the costs of those risks? How much risk can I mitigate with my current capabilities?

- How much control do I want or need to go “smart”? What areas do I want to control myself and how? Can I afford to control those areas?

- What is your real value to customers and your channel? Why do they buy from you, and why do they come back? What do you do well?

The third dimension is the company’s ability to manage transformation. Going “smart” doesn’t stop with the IoT technology. The entire organization, its operations, policies, systems and business models must transform to support and operate the “smart” business. Furthermore, resellers and service channels, and suppliers and partners, are also impacted.

- What is your corporate culture and how well does it support change? Do you have the right people to manage and sustain this change? Are you nimble and agile?

- What degree of disruption will there be to internal processes, channels, organization readiness, and business models? How agile are your current capabilities?

- How prepared are you to operate a “smart” business? Do you have the skills and infrastructure required? Can you support a recurring revenue business model? How willing are you to invest in order to develop and sustain these capabilities?

- Check out Make or Buy an IIoT platform? for more information on this.

What should you do next?

Each company is unique, and its situation will dictate its response to these dimensions. There is no one “right” universal answer to the “build, buy, partner” decision. Equally important, what’s right today, may not be right tomorrow. Companies that want to go “smart” start by looking inward first and doing the following:

- Establish a current baseline. Audit and catalog current and planned offerings, strategy, human resources and skill sets, channel and suppliers, internal operations and policies, and culture.

- Evaluate the IoT product management stack (Figure One) against your baseline using the three “smart” dimensions. The list of questions listed are starter questions, but answering those will lead to more questions to be addressed.

- Evaluate and assess your company’s future state capabilities against the baseline using the three “smart” dimensions. Understand where the gaps are, and the extent of those gaps.

- Identify your risk tolerance level. Going “smart” is not without risk, especially if you have never done it before. The key is to identify what and how much risk you are willing to take. Once you do so, you can develop a risk management plan and incorporate the appropriate tactics to manage it.

- Update your business vision and strategy as applicable.

- Develop your “build, buy, partner” decision and strategy. This strategy must align to the broader business vision and strategy.

Originally the article was published here.

This article was written by Benson Chan, a Senior Partner at Strategy of Things, a transformation management consultancy helping companies innovate for a hyperconnected world. He has over 25 years of scaling innovative businesses and bringing innovations to market for Fortune 500 and start-up companies.

This article was written by Benson Chan, a Senior Partner at Strategy of Things, a transformation management consultancy helping companies innovate for a hyperconnected world. He has over 25 years of scaling innovative businesses and bringing innovations to market for Fortune 500 and start-up companies.