Why Fleets Will Drive Adoption of Electric Vehicles

Electrification is one of the most significant trends in transport today. Future demand for both electric vehicles (EVs) and the associated electric vehicle supply equipment (EVSE) will, of course, be driven by increased adoption of electric vehicles by individuals and businesses. In this post, I will be making the case that the economics of EVs prove particularly favorable for fleet operations, focusing on full-battery as opposed to plug-in hybrid electric vehicles (BEVs vs. PHEVs).

Electric Vehicles Have Operating Cost Advantage

Electric vehicles are cheaper to operate than those powered by fossil fuels.

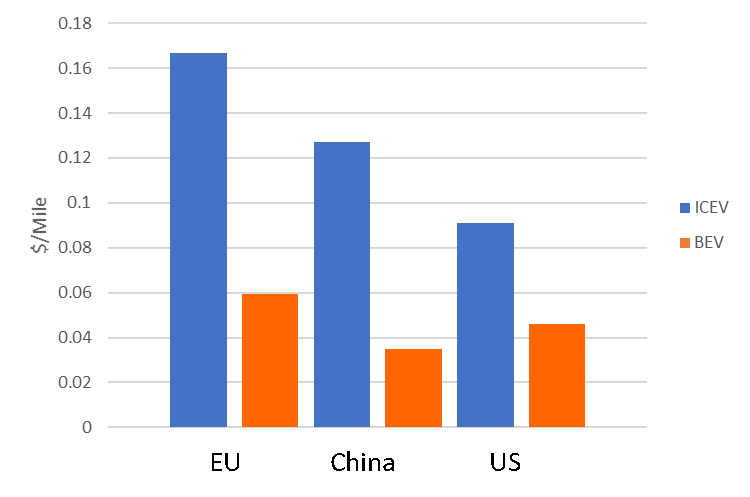

To start, electric powertrains have lower energy costs on a per-mile basis than internal combustion engines. They convert energy into motion more efficiently, with today’s BEVs attaining the miles per gallon equivalent (MPGe) of around three times the MPG of their traditional counterparts. Electricity and gasoline prices vary significantly by region, with some countries imposing heavy taxes on transport fuel. The figure below draws a comparison between both powertrains’ per-mile energy costs using standard efficiencies and energy prices from cities in three major EV markets.

Beyond enjoying lower energy costs, BEVs have fewer moving parts than internal combustion engine vehicles (ICEVs) and forgo liquid fuels entirely. Below is a list of part replacements/maintenance/issues that BEV owners do not need to worry about:

- Oil changes, oil filters

- Spark plugs, wiring, ignition coils

- Muffler, timing belt, catalytic converter, air intake filters

- Fuel filters, fuel injector cleaning

- Engine sludge

- Emissions checks

- Less frequent brake replacement due to regenerative braking

An EV owner does need to be mindful of their lithium-ion battery, as these lose charging capacity over time and may need to be replaced. Fortunately, data from drivers of Tesla and Chevy BEVs point to significant battery resilience.

BEVs are expected to last a long time thanks to their simplicity and lower number of moving parts. For this reason, an owner may find that when a battery does eventually wear out, it may make sense to replace it instead of buying a new vehicle. Furthermore, since grid/building operators are making use of Li-ion batteries to improve power quality and better integrate renewables, the residual value of a lower capacity BEV battery is expected to be far larger than the scrap value of an entire ICEV.

Fleets Set to Benefit Most

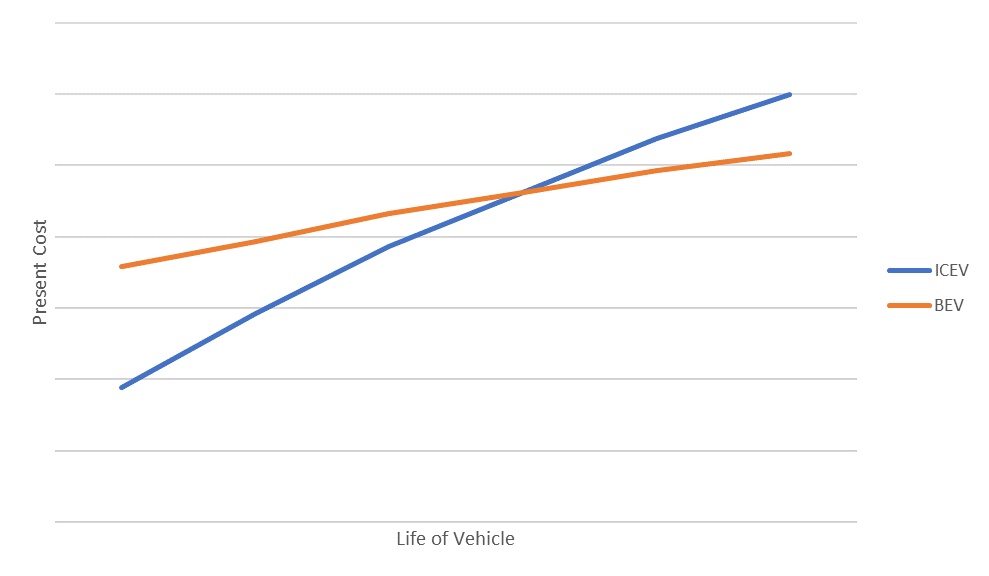

EV operating cost advantages are significant but come at a higher vehicle purchase price. Considering a company’s opportunity cost of capital, a high acquisition price upfront can actually be quite a bit costlier than it seems, and this capital opportunity cost only grows with the vehicle’s lifespan. It follows, then, that EV users with high vehicle uptime (such as ride-hailing, car-sharing, delivery, and city bus fleets) offer the strongest business case for going electric. Below is a comparison of how the present cost of ownership (with future expenditures discounted by compounded opportunity cost) develops over the life of a high-use BEV and a high-use ICEV. Following procurement, the ICEV cost is lower, but as higher operating costs accumulate, the BEV becomes more economical.

Urban Factors for Electric Vehicles

The World Health Organization estimates that 70 percent of the world’s population will live in urban environments by 2050. The kind of fleet services mentioned above predominantly operate in urban areas, which also happen to be particularly well suited for BEVs.

Fleets in urban areas generally run enough miles per day to capitalize on lower BEV operating costs, but not so many as to require uneconomically large batteries for a day’s activity. They also encounter plenty of stop-and-go traffic, making great use of regenerative braking and superior idling efficiency.

As climate change awareness and sensitivity to air pollution grow, cities have begun curtailing, taxing, and even banning emissions-producing vehicles from city centers, as well as charging them ever-higher urban access fees. City dwellers, particularly those that use ride-sharing services, tend to be environmentally conscious. This can make a “clean” BEV fleet particularly attractive and bolster a brand’s image as green and socially responsible.

Electromobility is beginning to make a lot of sense for fleet operations, and electrification announcements from UPS, Alphabet’s Waymo, and a myriad of taxi companies suggest that firms are taking notice. The trend is driven by compelling economics and will be one worth watching in the transportation space.

ARC is preparing a market analysis report on the global electric vehicle supply equipment (EVSE) market.

This article was written by Eddie Fidler from ARC Advisory. Originally the article appeared here.